ADMISI London Wheat Report for 10 October

- October 11, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

Another day of continued violence and attacks in Israel and Gaza with no imminent sign of de-escalation. Further rockets were fired by Hamas again at 15.00 BST and airstrikes continue with a ground invasion inevitable. Horrific scenes with innocent civilians on both sides taking the brunt. Token potshots are appearing from the Lebanese border and one can only hope a flare up does not drag more into this. Australian politics are getting more divided over the Indigenous bill. Keir Starmer gets glitter bombed at the Labour party conference in Liverpool earlier today.

Wheat news today was pretty flat. Russian wheat crop reaches 91Mmt with 92% of the area harvested. Market chatter that GASC is holding talks to buy Russian wheat according to traders today. Currently, reported weak market demand and a continuing decline in Russian market prices alongside the continued building of a harvest surplus continues to suppress prices. FOB Black Sea 12.5% for early Nov was sat at $230/t last week, down $5 on a week prior according to IKAR. Ukraine also said that a further 12 more cargo vessels were ready to enter a fledgling Black Sea shipping corridor on their way to Ukrainian ports. French wheat harvest estimates are pegged at 35.1Mmt.

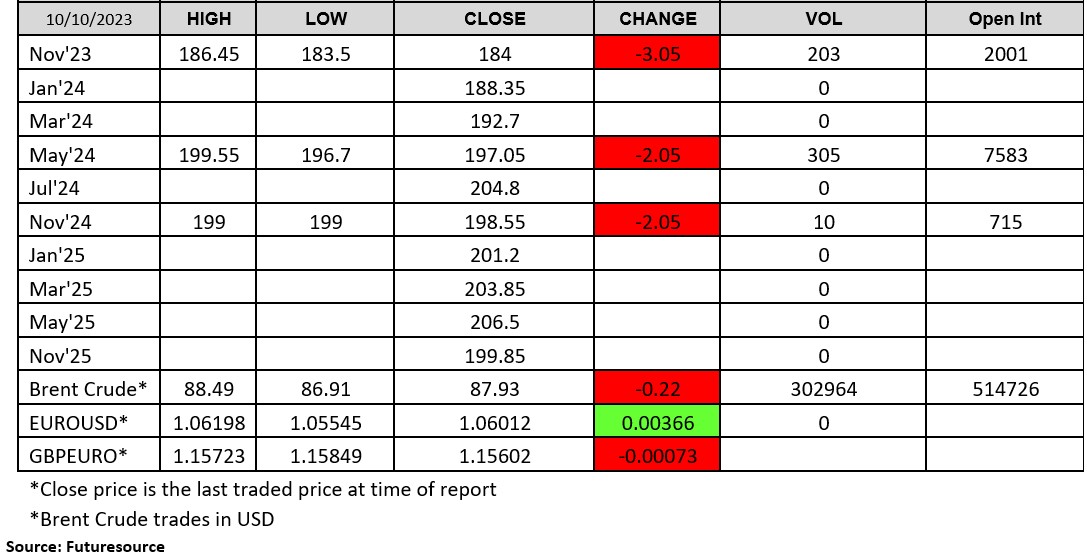

Chicago wheat fell in today’s trading with Dec-23 sitting around the 560 levels, 12 cents down at time of writing. Matif wheat also pushed lower, with Dec-23 settling down €2.75 on yesterday at €234.50/t. London wheat was also weaker with the Nov23/May24 spread trading around the -13/-13.5 level.

US weekly corn sales were down 18% in line with projections. Algeria was tendering for 120kt of corn for Nov, South American origin. Brazilian corn exports are seen reaching 9.174Mmt in October VS a year ago. French farm ministry upped the grain maize output to 11.78Mmt VS 11.22Mmt estimated a month ago. Chicago corn was trading marginally lower.

Brazilian soybean farmers are on track to harvest a record 162Mmt of soybeans, 4.8% up on last year. Chicago soybeans were supported into the latter half of the afternoon. Matif rapeseed was also trading lower with Feb-23 settling down €7.00 on yesterday at €437/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.