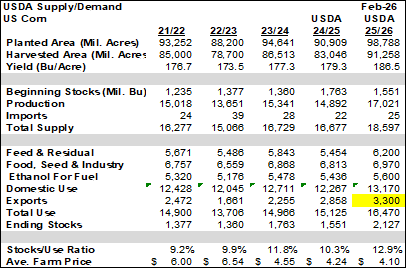

CORN

Prices finished steady to $.01 higher in 2 sided trade. The initial reaction to today’s USDA data saw prices shoot up to session highs before pulling back to fractionally higher. The higher export forecast will need to prove itself overtime in face of what will likely be higher SA production in subsequent USDA reports. US ending stocks remain the highest in 7 years, stock/use at 12.9% the highest in 6. The Ave. farm price was left unchanged at $4.10 per bu. Spot Mch-26 futures remain stuck between $4.15-$4.40.

- US 25/26 Corn stocks down 100 mil. bu. to 2.127 bu. vs. expectations of no change

- Exports raised 100 mil. bu. to record 3.30 bil.

- World stocks down 2 mmt to 289 mmt vs. expectations of no change

- South American production left unchanged

- Ukraine exports cut 1 mmt to 22 mmt

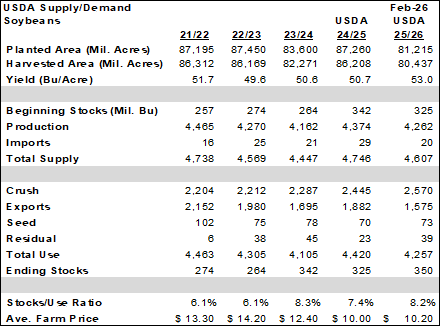

SOYBEANS

Prices were higher across the complex with beans up $.10-$.13, meal was $3 higher while oil was up 55-60 points closing into new contract highs. Prices initially broke with the release of the USDA data only to quickly recover to pre-report levels. The USDA kicked the demand dilemma down the road at least a month as we await to see if additional Chinese demand emerges. It’s hard to envision China buying another 8 mmt of US beans as US FOB offers remain $.80-$1.10 above Brazil thru May-26. With an improved weather forecast look for higher SA production in future reports. While there were no flash sales today, reports of mold in early soybean harvest in Brazil’s northern state of Mato Grosso has provided support. These mold issues are a result of too much rain. Yesterday US Treasury Sec. Bessent acknowledged a Sr. US Treasury official visited China last week to “strengthen channels of communication” between the world’s 2 largest economies. Bessent is expected to meet with China’s Vice Premier ahead of Pres. Trump’s proposed trip to China in April. Surprised the USDA made no change to bean oil usage for biofuel production, holding steady at 14.8 bil. lbs., up 26% YOY with usage down 20% after 2 months of data for the 25/26 MY. EPA decision on RVO’s and SRE next month with potential Trump visit to China in April.

- No changes to the 25/26 balance sheet with ending stock staying a 350 mil. bu.

- Product balance sheets also unchanged

- Global stocks rose 1 mmt to 125.5 mmt, in line with expectations

- Brazilian production increased 2 mmt to record 180 mmt

- Brazil’s crush up 1 mmt to 61 mmt while stocks also up 1 mmt

- Production in Paraguay increased .5 mmt to 11.5 which was absorbed with higher crush

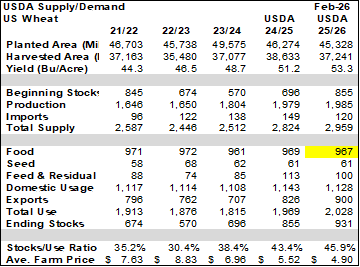

WHEAT

Prices held within a few cents of unchanged across the 3 classes. Mch-26 CGO can’t seem to get too far removed from its 100 day MA. Mch-26 KC continues to bounce off its 50/100 day MA support. The central US will see above normal temperatures the next 2 weeks. By this weekend heavy rains are expected in the SE plains before stretching across the Delta and southern Midwest by early next week. Little if any moisture for the NW third of the corn/soybean belt and northern plains.

- US 25/26 stocks up 5 mil. to 931 mil. bu. a 6 year high vs. expectations of down 10 mil.

- HRS food usage was down 5 mil.

- World stocks down nearly 1 mmt to 277.5 mmt vs. expectations of no change

- Argentine wheat production up .3 mmt to 27.8 mmt

- Argentine exports up 2 mmt to 18 mmt, Canada up 1 mmt to 29 mmt

- Russian and Ukraine exports left unchanged at 44 and 14 mmt respectively

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.