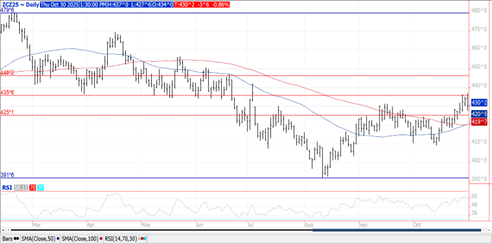

CORN

Prices were $.02-$.04 lower in choppy 2 sided traded. Early strength in spreads couldn’t hold, easing into the close. Dec/Mch traded up to a fresh 6 month high at $.11 ½ before fading. Dec-25 rejected trade into a fresh 4 month high. Moving Ave. support below the market comes in at $4.20. No mention of China interest in US corn helped fuel today’s bearish sentiment. The European Commission kept their EU production forecast unchanged at 56.8 mmt, vs., the USDA forecast of 55.3 mmt. With the partial Fed. Govt shutdown now in its 5th week, no export sales today however analysts expect sales last week to have ranged from 45-85 mil. bu. It’s estimated speculative traders bought nearly 3k contracts of corn yesterday cutting their net short position to around 70k contracts. Despite US exports and corn usage for ethanol holding up well, feed usage is likely being overestimated by the USDA. Unless US yields fall to 180 bpa, from the current record of 186.7, it’s difficult to envision a scenario for US 25/26 stocks falling below 2.0 bil. bu. US corn acres in drought fell 2% in the past week to 30%.

SOYBEANS

Prices were sharply mixed with beans $.08-$.13 higher, meal was up another $4-$7, while oil was down 50 points. Spot Nov-25 beans peaked at a 13 month high just above $11 and just below the Sept-24 high at $11.04 ¼. Strength was fueled by US Treasury Sec. Bessent statement that China has agreed to purchase 12 mmt of US soybeans for the 25/26 MY by the end of Jan-26 and 25 mmt of US soybeans over the next 3 years, coinciding with Pres. Trump’s term. Dec-25 meal continues to soar reaching a fresh 7 month high while extending its run of consecutive higher closes to 13. Recall meal is the 1 area of the soybean complex where speculative traders still hold a significant short position which I estimate is down to 70-75k contracts after today’s trade. With a resumption of soybean sales to China, US crushers will have increased competition for US soybeans which may see lower crush and lower meal supplies than previously discounted. Bean oil continues to lose share of crush PV as uncertainty over the application of Z45 tax credits and the EPA’s effort to reallocate lost biofuel demand to big oil as a result of the SRE has clouded the demand picture. Major support for Dec-25 oil rests at the September lows of 48.89. Spot board crush margins slipped a penny to $1.49 ½ bu. while bean oil PV fell to a 7 month low at 44%. Sec. Bessent also went on to state other Asian countries have agreed to buy an additional 19 mmt of US soybean without laying out a timeframe. Pres. Trump took to Truth Social seemingly claiming a victory for the American farmers by stating that “farmers should go out and buy more land and larger tractors.” US soybean sales last week are expected to have ranged between 20-55 mil. bu. For Chinese bean purchases to reach 12 mmt (nearly 440 mil. bu.) by the end of Jan-26 they will need to buy roughly 33 mil. bu. per week. In the past decade Chinese purchases of US beans have averaged roughly 27 mmt (990 mil. bu.) per MY.

WHEAT

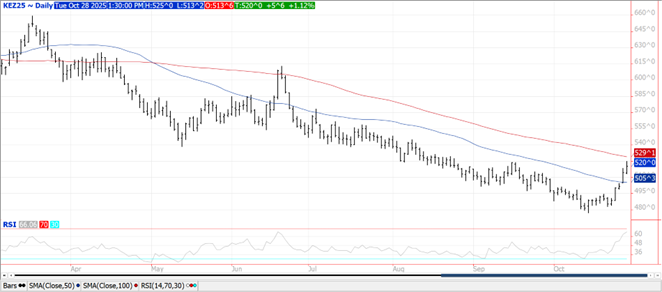

With little to no fundamental justification for the recent price runup, wheat tumbled $.08-$.10 across the 3 classes today. Dec-25 CGO carved out a new high for the month however stopped ¼ shy of the September high. Similar to corn, no mention of any Chinese interest in US wheat. Both CGO and KC Dec-25 contracts have support below the market at their respective 50 day MA’s, with resistance at their 100 day MA’s. Ukraine’s 25/26 wheat exports as of Oct. 29th at 6.15 mmt are down 20% YOY. Their winter wheat plantings at 82%, or 3.86 mil. HA trail the YA pace of 4.1 mil. HA. US wheat sales last week are expected to have ranged between 12-22 mil. bu. The EC raised their EU 25/26 production forecast .8 mmt to 133.4 mmt, vs. the USDA est. of 140.1 mmt. The EC kept their export forecast unchanged at 31 mmt, vs. the USDA est. of 32.5 mmt.

Charts provided by QST.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

Crude Jumps on Gulf Disruption

March 9, 2026

Iran Conflict Continues to Weigh on Sentiment

March 9, 2026